.jpg%3Fformat%3Dwebp&w=3840&q=75)

.jpg%3Fformat%3Dwebp&w=3840&q=75)

Top VHIS winner¹

vPrime Medical Plan

Full cover² for a series of hospitalisation and surgical expenses, up to HK$12.5 million per Policy Year and without Lifetime Benefit Limit

I am applying for

Gender

Age

All premiums are calculated on standard rates and this quote is for reference only. The premium levy, which we’re obliged to collect for the Insurance Authority, is payable in addition to the actual premium to be paid.

Before proceeding, please confirm you understand this product’s features and that it fits your need(s) and affordability.

Why needs vPrime?

vPrime Medical Plan (“vPrime”)3 provides full cover2 for a series of hospitalisation and surgical expenses up to HK$12.5 million per Policy Year and without Lifetime Benefit Limit for your future protection. vPrime3 is a “5-star”4 VHIS, not only alleviating your medical burden, but also allowing tax deductions5!

"5-Star"4 Medical Insurance Plan, providing comprehensive coverage for you and your family's medical needs, received various awards and accolades6, including:

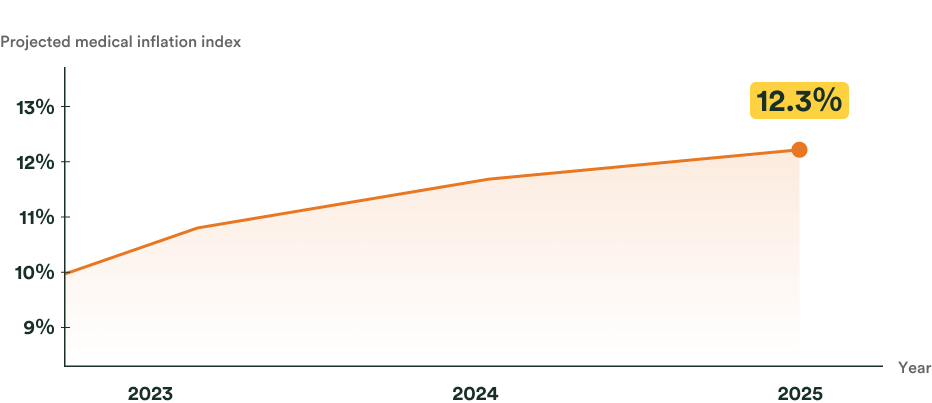

Is consulting a doctor getting more expensive? vPrime can help you!

Projected Medical Inflation Index in the Asia-Pacific Region7

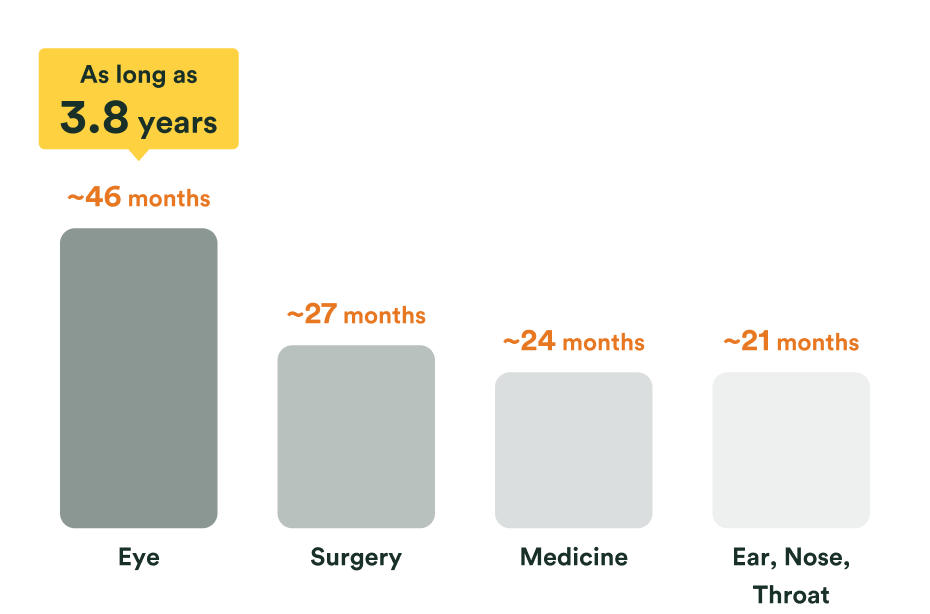

Long waiting times at public hospitals? vPrime can help you!

Waiting Time for New Case Booking for Specialist Out-patient Services in Hong Kong public hospitals8

Although public hospital fees in Hong Kong are relatively affordable, the waiting time for new case booking for specialist out-patient service can be as long as 3.8 years, which may lead to missing the best opportunity for treatment!

Although public hospital fees in Hong Kong are relatively affordable, the waiting time for new case booking for specialist out-patient service can be as long as 3.8 years, which may lead to missing the best opportunity for treatment!What’s special about vPrime?

Full cover for a series of hospitalisation and surgical expenses, up to HK$12.5 million per Policy Year and without Lifetime Benefit Limit

With the rapid advancement in medical technology, the biggest fear is not being ill, but being unable to afford the treatment cost!

approx. HK$270K9

Out-of-pocket medication cost in the public hospital

approx. HK$1.29M9

Overall treatment cost in the private sector

vPrime3 provides up to HK$12.5 million per Policy Year for eligible medical expenses and cash benefits, and without Lifetime Benefit Limit!

Utilise 6 deductible options to make premiums more affordable

| Deductible options10 | Monthly premium at 1st year* (based on ANB31) |

|---|---|

| HK$0 | HK$917 |

| HK$16,000 | HK$289 |

| HK$25,000 | HK$248 |

| HK$50,000 | HK$189 |

| HK$100,000 | HK$149 |

| HK$250,000 | HK$119 |

Deductible to be waived for designated crises

Relieving the financial burden of treatment, allowing you to focus more on healing and recovery.

(Age next birthday: 37)

has applied for vPrime3 – Deductible HK$250,000

Policy effective date – 1 September 2024

| Treatment expenses for breast cancer |

HK$ 180,000 12 |

|---|---|

| minus Deductible10 |

If unfortunately diagnosed with a designated illness13, the deductible10will be waived under First-dollar coverage – Deductible waived for designated crises10,13,14.

|

| Total payout amount | HK$180,000 |

Innovative cash benefits in the VHIS market provides additional financial support

In specified circumstances, additional cash benefits will be provided.

| Deductible options10 | HK$0 | HK$16,000 | HK$25,000 |

|---|---|---|---|

| Cash benefits | Cash benefits amount | ||

| (1) Day case procedures15 | HK$1,600 per procedure Max. 1 Day Case Procedure per day | ||

| (2) Reimbursement paid by other insurance companies16 | HK$800 per day of Confinement Max. 60 days per Policy Year | ||

| (3) Admission to standard ward room in HK private hospital17 | HK$1,600 per day of Confinement Max. 30 days per Policy Year | ||

| (4) Major and complex surgeries18 | HK$5,000 per major surgery HK$10,000 per complex surgery (Max. 1 major or complex surgery per day) | ||

| (5) Confined in Intensive Care Unit in HK19 | HK$10,000 per Confinement | ||

| Deductible options10 | HK$50,000 | HK$100,000 | HK$250,000 |

|---|---|---|---|

| Cash benefits | Cash benefits amount | ||

| (1) Day case procedures15 | HK$1,600 per procedure Max. 1 Day Case Procedure per day | HK$800 per procedure

Max. 1 Day Case Procedure per day | |

| (2) Reimbursement paid by other insurance companies16 | HK$800 per day of Confinement Max. 60 days per Policy Year | HK$500 per day of Confinement Max. 60 days per Policy Year | |

| (3) Admission to standard ward room in HK private hospital17 | HK$1,600 per day of Confinement Max. 30 days per Policy Year | HK$800 per day of Confinement

Max. 30 days per Policy Year | |

| (4) Major and complex surgeries18 | HK$1,000 per major surgery HK$2,000 per complex surgery (Max. 1 major or complex surgery per day) | ||

| (5) Confined in Intensive Care Unit in HK19 | HK$2,000 per Confinement | ||

Up to 25% no claims premium discount

Maintain good health to enjoy higher discounts and be rewarded for a healthy lifestyle.

| No claims period immediately prior to the Policy’s Renewal20 | No claims premium discount (Applicable to Renewal20 premium) |

|---|---|

| 2/3/4 consecutive Policy Years | 10% |

| 5 consecutive Policy Years and thereafter | 15% |

| Number of eligible policies21 | Extra no claims premium discount22 under your eligible policies21 |

|---|---|

| 2 or 3 | 2.5% |

| 4 | 5% |

| 5 or above | 10% |

| FWD vPrime3 | Company A VHIS | Company P VHIS | |

|---|---|---|---|

| Self Application | 15% | 15% | 15% |

| Application for self and family | 25% |

Comprehensive medical cover

The protection you need to safeguard your health

Covering unknown Pre-existing Conditions at the time of application, including Congenital Condition(s)

FWD Care third-party professional health assistance services24,25 for the support you need

Enhanced benefits to support you on your road to health again

Extra support for stroke rehabilitation

A trusted plan with VHIS features

vPrime3 is certified by the Government and Policy Holders are eligible for tax deduction5

Guaranteed Renewable20 up to Age 100 of the Insured Person

During and after pregnancy, taking care of the health of both mothers and babies

Pregnancy complications benefit

Free coverage for newborns

Child development benefit

Worry about failure to get reimbursed by an insurance, and cannot claim the full cost of hospitalisation or treatment expenses31? Do not want to worry about the claim process?

Cashless Facility Service for hospitalisation and day case procedures

Cashless Facility Service24,30 = Receiving treatment without having to make a payment from the start to completion31

Hospital network covering Pan-Asia regions for Cashless Facility Service for hospitalisation:

All HK private

hospitals (13 in total)32,33

All 3A hospitals

Apart from hospitalisation, you can also enjoy Cashless Facility Service for day case procedures:

General Information

Standalone Plan

Age 0 (from 15 days) – 80 (attained age)

Guaranteed yearly renewable20 to age 100 (attained age)

- Based on Insured Person’s attained age at issue

- Renewal20 premiums are non-guaranteed and will be determined annually and according to the Insured Person’s attained age at the time of renewal20

To Age 100 (attained age)

This platform offers Monthly and Annual premium payment mode

Policy holder can contact FWD Customer Service to amend premium payment mode after policy is effective

HKD

| Deductible10 options | certification numbers |

|---|---|

| HKD0 | F00045-01-000-04 |

| HKD16,000 | F00045-02-000-04 |

| HKD25,000 | F00045-03-000-04 |

| HKD50,000 | F00045-04-000-04 |

| HKD100,000 | F00045-05-000-02 |

| HKD250,000 | F00045-06-000-02 |

vPrime Medical Plan is underwritten by FWD Life Insurance Company (Bermuda) Limited (incorporated in Bermuda with limited liability) ("FWD Life/ FWD/We"). This eCommerce Platform is operated by FWD Financial Limited ("FWD Financial"). FWD Financial is an appointed and licensed insurance agency of FWD Life.

⁺vPrime Medical Plan won the Grand Award of "Most Innovative Product/Service Award - Voluntary Health Insurance Scheme" in Hong Kong Insurance Awards 2021 & 2022, Excellence Award from "VHIS plans series" and one Outstanding Awards from "Health & Protection” Financial Institution Awards 2022 by Bloomberg Businessweek.

The product information in this website is for reference only and does not contain the full terms and conditions, key product risks and full list of exclusions of the policy. For the details of benefits and key product risks, please refer to the product brochure; and for exact terms and conditions and the full list of exclusions, please refer to the policy provisions of vPrime.

Please make sure you are eligible for this product before applying:

- I (and the Insured person if applicable) am a permanent HKID card holder with a Hong Kong residential address.

- Currently in Hong Kong at the time of making this application.

- I will not or have no intention to live or work outside Hong Kong or home country over 183 days in the coming 12 months.

- I am not a holder of the People’s Republic of China Resident Identity Card.

Note: Online applicants will be requested to visit FWD Insurance Solutions Centres under the following circumstances: 1) Collection of policy documents upon issuance of policy; 2) Cancellation of policy during the cooling-off period; 3) Change of beneficiary; or 4) Full surrender. Under specific circumstances, we may request online applicants to visit FWD Insurance Solutions Centres for identity verification.

Not exactly what you need?

If you’re looking for more coverage, simply contact us and we’ll get back to you with more information.

Frequently Asked Insurance Questions

The Voluntary Health Insurance Scheme (VHIS) is a policy initiative introduced by the Health Bureau. VHIS products are individual indemnity hospital insurance products complied with the minimum requirements set out by the Health Bureau. It aims to enhance the protection level of individual indemnity hospital insurance products, provide the public with an additional choice of using private healthcare services through individual indemnity hospital insurance, and relieve the pressure on the public healthcare system in the long run. VHIS also allows you to enjoy tax deduction5.

Facing sudden illnesses, taking out medical insurances earlier can provide you with protection, allowing you to easily handle hospitalisation and surgical expenses. One of the benefits of choosing VHIS is that it can cover unknown pre-existing conditions at the time of application (subject to relevant waiting periods) and guarantee renewal up to the age of 100 (attained age). Additionally, the plan must comply with the government's standard terms and conditions, minimum coverage, and benefit limits, allowing you to enjoy higher protection and transparency.

The terms of medical insurance plans in general vary by insurance companies, while VHIS is certified by the government and must be complied with several standard product requirements to enhance consumer protection. Besides, VHIS is eligible for tax deduction5.

.svg?format=webp)