Savings Insurance

Easy WealthPlus Endowment Plan 2

[Limited offer¹] Lock in an 8-year guaranteed return of up to 4.30% p.a.² Move beyond the fear of the coming of rate-cut cycle.

Gender

Age

HK$

US$

(1) The total premium limit of Easy WealthPlus Endowment Plan 2 is US$50,000 via online application (per policy owner).

(2) Online banking is only applicable for premiums less than or equal to HK$100,000.

Choose a plan

Have a promo code?

(1) The total premium limit of Easy WealthPlus Endowment Plan 2 is US$50,000 via online application (per policy owner).

(2) Online banking is only applicable for premiums less than or equal to HK$100,000.

All premiums are calculated on standard rates and this quote is for reference only. The premium levy, which we’re obliged to collect for the Insurance Authority, is payable in addition to the actual premium to be paid.

Before proceeding, please confirm you understand this product’s features and that it fits your need(s) and affordability.

- Lock in an 8-year guaranteed return of up to 4.30%² p.a. during the rate cut cycles

- Save an education fund for your children to help them achieve their dreams

*Source: 10Life Insurance Comparison Platform. FWD Easy WealthPlus Endowment Plan 2 has achieved Savings Insurance Certification (Education) in 10Life Happy Kids Certification 2024 (As of 24 OCT 2024). For details, please visit www.10Life.com

[Limited Offer] Lock in an 8-year guaranteed return of up to 4.30% p.a.

From now till 31 May 2025, by taking out Easy WealthPlus Endowment Plan 2, you can enjoy the premium discount!

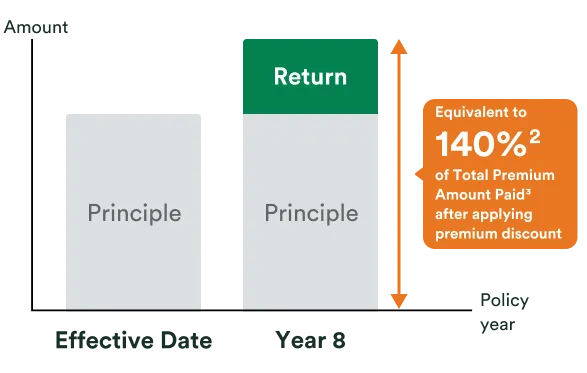

If you choose to pay the premium by prepay option, you can enjoy 15% premium discount on the first year, allowing you to lock in an 8-year guaranteed return of up to 4.30% p.a. after such premium discount, which is equivalent to 140% of the Total Premium Amount Paid3 after applying such premium discount!

If you choose to pay the premiums by annual pay, you can enjoy 7% premium discount on the first year, allowing you to lock in an 8-year guaranteed return of up to 4.01% p.a. after such premium discount, which is equivalent to 134.2% of the Total Premium Paid4 after applying such premium discount!

Terms and conditions apply.

How to continue enjoying high interest income?

No one has a crystal ball to foresee the time of rate hikes or rate cuts.

FWD Easy WealthPlus Endowment Plan 2 (“Easy WealthPlus 2”) is a savings plan, you can lock in an 8-year interest income of up to 4.30% p.a.² if you choose to pay your premium by prepay option.

Combination of savings (100% guaranteed), life protection and continuous policy extension functions in one plan.

If the insured passes away during the benefit term, the death benefit will be payable. Besides, the plan also provides different options for continuous policy extension.

Savings

Life protection

Policy continuation

Who needs medium-term savings insurance?

High-interest hunters

Investors with low-risk appetite

No.1 Parents

Pre-retirees

Why Easy WealthPlus 2?

Lock in guaranteed return

Pay your premiums by prepay option, lock in an 8-year guaranteed return of up to 4.30% p.a.² immediately

Combination of savings (100% guaranteed), life protection and continuous policy extension functions in one plan

Savings | 100% guaranteed return of up to 4.30% p.a.2 |

|---|---|

Life protection | Death Benefit11= higher of 105% of the total premium paid4 or guaranteed cash value |

Continuous policy extension |  Unlimited times for change of insured  Nomination of contingent insured and contingent policy owner |

Savings | Life protection | Continuous policy extension |

|---|---|---|

100% guaranteed return of up to 4.30% p.a.2 | Death Benefit11= higher of 105% of the total premium paid4 or guaranteed cash value |  Unlimited times for change of insured  Nomination of contingent insured and contingent policy owner |

Easy and fast online application

From quotation to premium payment via online banking, the entire process can be completed online, allowing you to complete the application promptly.

FWD strong foundation offers you confidence

Top 1 online and direct platform new business case count in Hong Kong6

Over HK$ 100 billion in total asset size7

Case illustration8

Prepay option

Pay the 1st year premium of US$12,500 together with the prepayment amount 9 for 2nd year premium of US$12,5009 upon policy application, total amount paid is

End of Policy Year | Total Premiums Paid9 | Prepayment amount deposited into the PDA | Balance of PDA | Guaranteed Surrender Benefit10 | Guaranteed Surrender Benefit10 + balance of PDA | Guaranteed Death benefit11 | Guaranteed Death benefit11 + balance of PDA |

|---|---|---|---|---|---|---|---|

1 | US$12,500 | US$12,500 | US$12,500 | US$9,439 | US$21,502 | US$13,125 | US$25,625 |

2 | US$25,000 | US$0 | US$0 | US$22,002 | US$22,002 | US$26,250 | US$26,250 |

3 | US$25,000 | US$0 | US$0 | US$22,500 | US$22,500 | US$26,250 | US$26,250 |

4 | US$25,000 | US$0 | US$0 | US$22,876 | US$22,876 | US$26,250 | US$26,250 |

5 | US$25,000 | US$0 | US$0 | US$23,670 | US$23,670 | US$26,250 | US$26,250 |

6 | US$25,000 | US$0 | US$0 | US$24,146 | US$24,146 | US$26,250 | US$26,250 |

7 | US$25,000 | US$0 | US$0 | US$24,619 | US$24,619 | US$26,250 | US$26,250 |

8 | US$25,000 | US$0 | US$0 | US$32,394 | US$32,394 | US$32,394 | US$32,394 |

Please note that the premium discount (if any) is not included in the example above.

Annual pay (2 years)

Pay the annual premium of US$12,5009 for the first 2 policy years, total amount paid is

End of Policy Year | Total Premiums paid9 | Guaranteed Surrender Benefit10 | Guaranteed Death Benefit11 |

|---|---|---|---|

1 | US$12,500 | US$9,439 | US$13,125 |

2 | US$25,000 | US$22,002 | US$26,250 |

3 | US$25,000 | US$22,500 | US$26,250 |

4 | US$25,000 | US$22,876 | US$26,250 |

5 | US$25,000 | US$23,670 | US$26,250 |

6 | US$25,000 | US$24,146 | US$26,250 |

7 | US$25,000 | US$24,619 | US$26,250 |

8 | US$25,000 | US$32,394 | US$32,394 |

Please note that the premium discount (if any) is not included in the example above.

General information

19 - 65

2 years

8 years

USD

- Annual pay (2 years)

- Prepay option (pay the 1st year premium together with the prepayment amount for 2nd year premium)

US$8,098 (per policy)

US$64,787 (per product per insured) 15

US$3,12519 (per policy)

US$25,00019 (per policy owner)

Easy WealthPlus Endowment Plan 2 is underwritten by FWD Life Insurance Company (Bermuda) Limited (incorporated in Bermuda with limited liability) ("FWD Life”/ “FWD”/”We"). This eCommerce Platform is operated by FWD Financial Limited ("FWD Financial"). FWD Financial is an appointed and licensed insurance agency of FWD Life (License No. FA2568).

The product information in this website is for reference only and does not contain the full terms and conditions, key product risks and full list of exclusions of the policy. For the details of benefits and key product risks, please refer to the product brochure; and for exact terms and conditions and the full list of exclusions, please refer to the policy provisions of the plan.

Please make sure you are eligible for this product before applying:

• I (and the Insured person if applicable) am a permanent HKID card holder with a Hong Kong residential address.

• Currently in Hong Kong at the time of making this application.

• I will not or have no intention to live or work outside Hong Kong or home country over 183 days in the coming 12 months.

• I am not a holder of the People’s Republic of China Resident Identity Card.

Note: Online applicants will be requested to visit FWD Insurance Solutions Centres under the following circumstances: 1) Collection of policy documents upon issuance of policy; 2) Cancellation of policy during the cooling-off period; 3) Change of beneficiary; or 4) Full surrender. Under specific circumstances, we may request online applicants to visit FWD Insurance Solutions Centres for identity verification.

Not exactly what you need?

If you’re looking for more coverage, simply contact us and we’ll get back to you with more information.

Frequently asked questions of savings insurance

The advantages of savings insurance are its ability to help policyholders accumulate savings steadily and achieve financial goals with a 100% guaranteed return. Additionally, savings insurance provides life protection for insured in the unfortunate event of the insured's demise before the policy's maturity date, the policy also offers death benefit.

No one can accurately foresee when the rate hiking cycle will be ended. By purchasing medium-term savings insurance such as Easy WealthPlus 2, customers can lock in an 8-year return rate with peace of mind. They do not have to worry about the return of their savings insurance to be disappeared within 3 or 5 years and losing their budget. In addition, Easy WealthPlus 2 provides 100% guaranteed maturity returns. You don’t have to worry about the returns being affected by other market factors and can achieve the medium-term goals at ease.

Easy WealthPlus 2 is designed to support your medium-term goals by offering 8 years benefit term. You can enjoy a guaranteed maturity return of up to 4.30% p.a.^^ as well as life protection.

^^Applicable to paying your premium by prepay option with the additional first year 15% premium discount

.svg?format=webp)