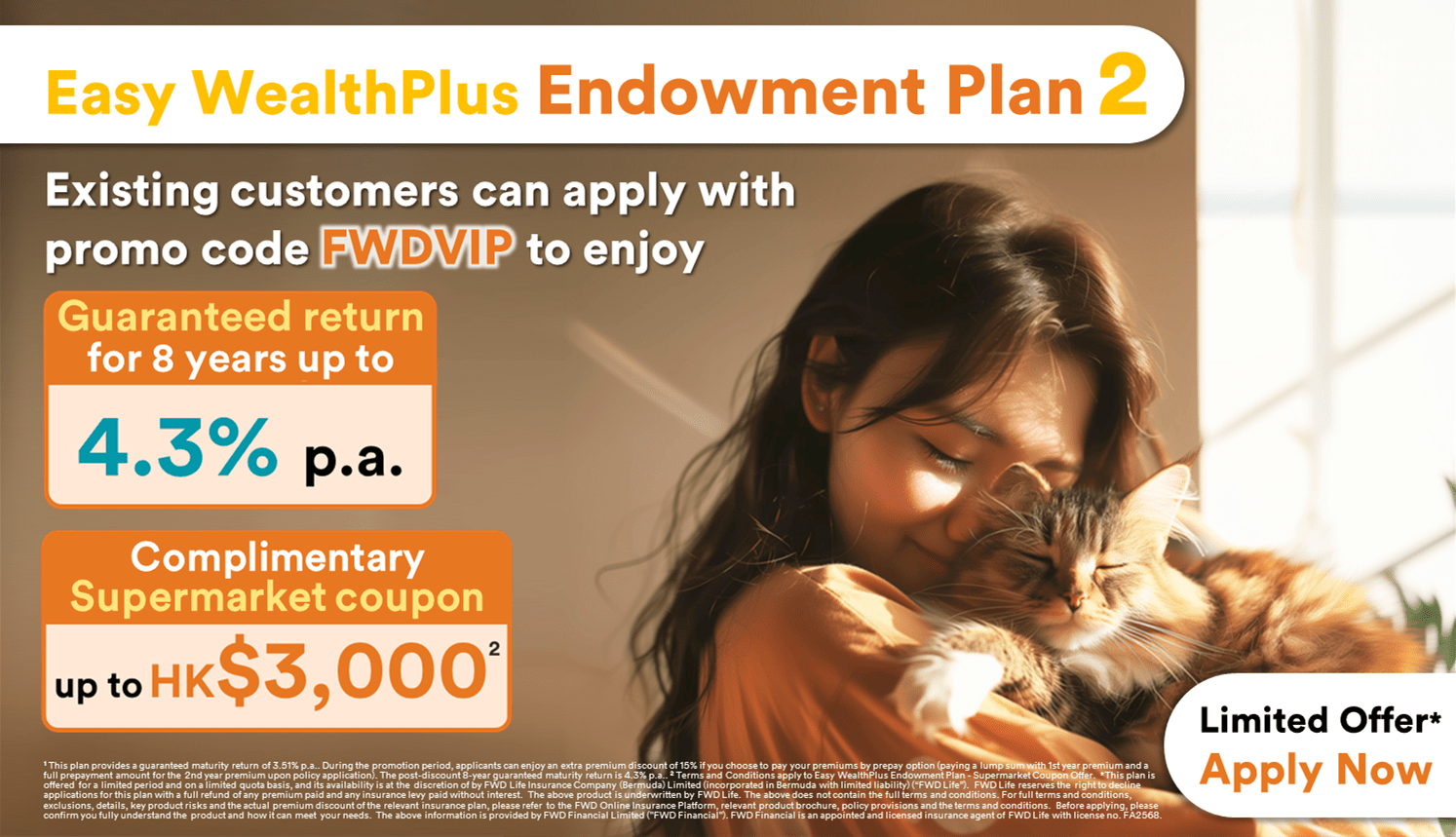

Limited time offer! From now on, successfully apply to lock in an 8-year guaranteed return of up to 4.3% p.a.*

Enjoy guaranteed return and turn your medium-term goals into your next milestones

Limited offer!

We all have different life goals with different time frames. While we are prepared to build a carefree retirement over a couple of decades or longer, there are also things on our to-do lists that can’t wait that long.

We’ve designed this plan to support your medium-term goals with a 2-year premium payment period and an 8-year benefit term.

* Terms and Conditions apply. Please refer to the promotional leaflet for the details of terms and conditions.

Available to buy via:

- FWD agents

- Insurance brokers

Achieve your savings target in 8 years with 2 years payment

You only need to pay premiums for the first 2 years, the plan offers 8 years’ benefit term to meet your different medium-term saving needs. You can pay your premiums either by annual pay or prepay option (i.e. paying a lump sum with 1st year premium and a prepayment amount for the 2nd year premium) upon policy application. If you choose the prepay option, we will deposit your prepayment amount into the premium deposit account (PDA).

Life protection for peace of mind

A lump sum death benefit will be payable to the beneficiary if the insured passes away. The death benefit is equivalent to the higher of (i) 105% of total premium paid or (ii) guaranteed cash value as at the date of insured’s death, and less any indebtedness and any outstanding levy. If the insured dies before the first policy anniversary (if the prepay option is chosen), any balance of PDA will be returned to you or your estate (if you are also the insured).

Unlimited times for change of insured

After the end of the 1st policy year and the insured is alive, you may exercise the change of insured option for unlimited times until the policy matures. After the change of insured, the benefit term and policy values remain unchanged.

Contingent insured and contingent policy owner for continuous policy extension

You can also nominate a contingent insured or a contingent policy owner to ensure smooth policy extension in any circumstances.

Easy application

Application for this plan is simple and no medical examination needed.

Interested?

Take a closer look at all the details – and feel free to contact us with any questions.

Helpful notes

- Age refers to the age of the insured on their next birthday.

The product information here is for reference only and doesn’t contain the full terms and conditions, key product risks and exclusions. For more details and key product risks, please refer to the product brochure. For the exact terms and conditions and a full list of exclusions, please refer to the policy provisions of the plan.

This product is underwritten by FWD Life Insurance Company (Bermuda) Limited ("FWD Life/ FWD"). FWD Financial Limited is an appointed and licensed insurance agency of FWD Life.

Get personalised advice

Start a live chat now

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used.

For more details please read our Cookie Policy.