Press release

CCB (Asia) and FWD Hong Kong officially launch an innovative bancassurance experience

Makes same-day policy issuance possible^ Apply for designated endowment plan to enjoy guaranteed maturity return of 4% p.a.#.

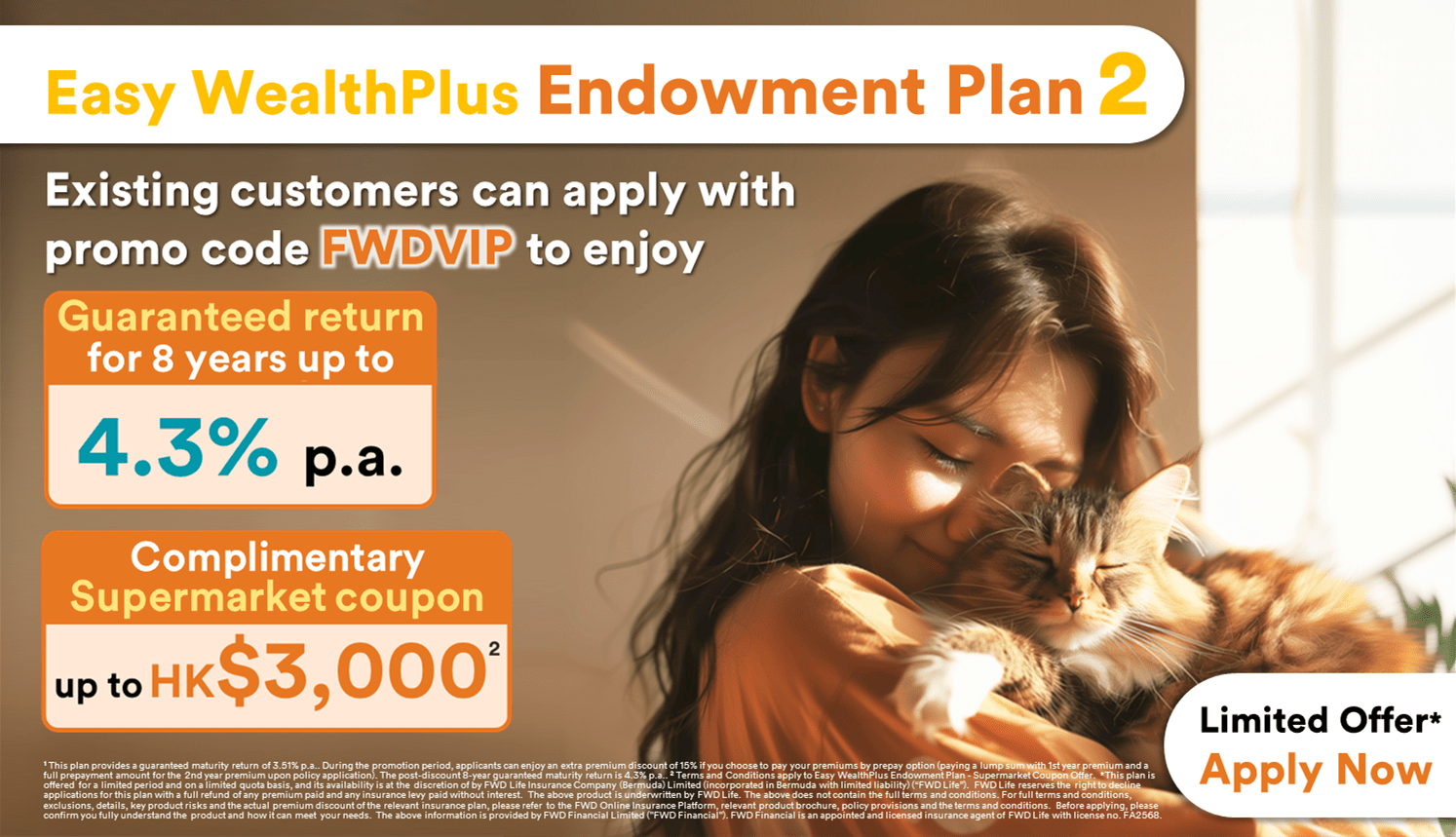

China Construction Bank (Asia) Corporation Limited (“CCB (Asia)”) and FWD Hong Kong (“FWD”) today announced the official launch of an Open Application Programming Interface (“Open API”) to bring customers an instant, secure and seamless bancassurance experience. Through Open API technologies, policies may take effect as soon as same day^, allowing customers to get the protection they need faster. Open API technologies also enhance data accuracy and customer privacy protection that contribute to a more innovative and efficient bancassurance experience. To celebrate the official extension of the Open API technology adoption to all FWD products available at CCB (Asia) branches, CCB (Asia) and FWD launched the Easy WealthPlus Endowment Plan with a guaranteed maturity return of 4% p. a.#.

CCB (Asia) and FWD connected their systems through Open API technologies in the trial phase, resulted in smoother operation and satisfactory customer feedbacks. In view of the positive response, the Easy WealthPlus Endowment Plan is now available on a “limited-time basis*” at CCB (Asia). With a single premium payment, customers can plan their future with ease by enjoying the 8 years benefit term with guaranteed maturity return of 4% p. a.#.

“As one of the financial institutions that provides Open Banking services, we are delighted to partner with FWD in offering our customers an innovative bancassurance experience. Open API technologies help enhance data accuracy and customer privacy protection. The launch of this Open API-based service marks a new chapter for our ongoing service enhancement powered by fintech and lays a solid foundation for CCB (Asia)’s more innovative and efficient banking services going forward,” said Annie Chen, CCB (Asia)’s Chief Retail Banking Officer.

Ken Lau, FWD’s Managing Director for Greater China and Hong Kong CEO, said, “FWD is committed to changing the way people feel about insurance by delivering unique digital experience and wealth management solutions. Over the years, CCB (Asia) and FWD have worked together to offer innovative products and services for our customers. The Open API collaboration initiative provides a more efficient and secure insurance purchase experience for CCB (Asia)’s customers. This has opened up even more opportunities to further deepen our partnership in fintech, bringing our digitally-enabled services to the next level.”

CCB (Asia) has been a long-term partner of FWD in the bancassurance business since 2007. Both companies signed a bancassurance partnership agreement for the next decade in May 2021. Previously, the two organizations jointly launched an innovative and convenient online cross-platform insurance service. CCB (Asia) and FWD also provide a new personalised insurance solution for banking customers, which meets their different protection needs, by supporting a more flexible wealth management planning. The partnership paves the way for further growth for both CCB (Asia) and FWD, demonstrating the fruitful outcome of a mutually beneficial partnership.

For more details about the Open API collaboration between CCB (Asia) and FWD, please visit www.asia.ccb.com/hk/openapi/en.

Remarks:

^ The related FWD policy may take effect within 1 working day at the soonest. Subject to terms and conditions of the relevant insurance product.

# The guaranteed maturity return is calculated based on the single premium paid and the maturity benefit (which is equal to 100% of notional amount less any indebtedness (if any)).

* The plan is offered for a limited time period and on a limited quota basis. Its availability is at the discretion of FWD Life Insurance Company (Bermuda) Limited (Incorporated in Bermuda with limited liability) (“FWD”). FWD reserves the right to decline applications for the plan with a full refund of any premium paid and any insurance levy paid without interest.

About China Construction Bank (Asia) Corporation Limited

China Construction Bank (Asia) Corporation Limited (“CCB (Asia)”) is the comprehensive and integrated commercial banking platform of China Construction Bank Corporation (“CCB”) in Hong Kong. As the flagship of CCB Group’s overseas business, CCB (Asia) holds a variety of licenses and provides a wide array of banking services including retail banking services, commercial banking services, corporate banking services and treasury business etc., along with its industry-leading advantages in RMB services, FinTech, cross-border services and green finance. Through the extensive network and diversified service channels of CCB Group in Mainland China and Hong Kong, CCB (Asia) provides comprehensive, one-stop and integrated finance solutions to individuals, corporate and institutional clients. Adhering to “market-oriented, customer-centric” business philosophy, with its integrated operational platform as the basis, FinTech as the core drive and innovation as the leading force, CCB (Asia) is committed to providing efficient, safe and novel smart banking services to the general public.

For more information about CCB (Asia), please visit www.asia.ccb.com.

About FWD Hong Kong and Macau

FWD Hong Kong and Macau are part of the FWD Group, a fast-growing pan-Asian life insurer with more than 10 million customers across 10 markets, including some of the fastest-growing insurance markets in the world. FWD is a top-3 life insurer by new business first year premium in Hong Kong+.

FWD Hong Kong has been assigned strong financial ratings by international agencies. It offers life and medical insurance, employee benefits, and financial planning. FWD Macau provides a suite of life and medical insurance products.

FWD reached its 10-year anniversary in 2023. The company is focused on making the insurance journey simpler, faster and smoother, with innovative propositions and easy-to-understand products, supported by digital technology. Through this customer-led approach, FWD is committed to changing the way people feel about insurance.

For more information about FWD Hong Kong and Macau please visit www.fwd.com.hk and www.fwd.com.mo.

+* Source: Provisional Statistics on Hong Kong Long Term Insurance Business - January to December 2021, Insurance Authority of Hong Kong. The calculation combines individual and group businesses.

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used.

For more details please read our Cookie Policy.